Creating a Growth Plan for Client Accounting Services

Growth can be challenging

Recognize that even if you’ve been in practice for ten years as a tax or audit practitioner, starting a CAS practice is a different venture. You will need to start with single and multi-year goals. Your first goal may be as simple as landing your first three to five clients. Depending on your market and market conditions, you may want to target $3 – 5,000 per month for each of these engagements. (Five $5,000 per month engagements would get you to an annual run rate of $300,000 per year within twelve months.)

You may want to target doubling first-year revenues in year two and choose something less aggressive for years three through five. Keep in mind as your practice doubles in volume, your team will get more efficient and effective so that probably won’t require that you double your staff.

Download our Free eBook!

Download our Free eBook!

Don’t sell yourself short

In the introductory years of the practice, you’re more likely to discount and underestimate fees (refer to the CAS Lifecycle eBook symptoms of introductory stage practice). Training from Sage-Intacct and CPA.com provides great tools for pricing engagements.

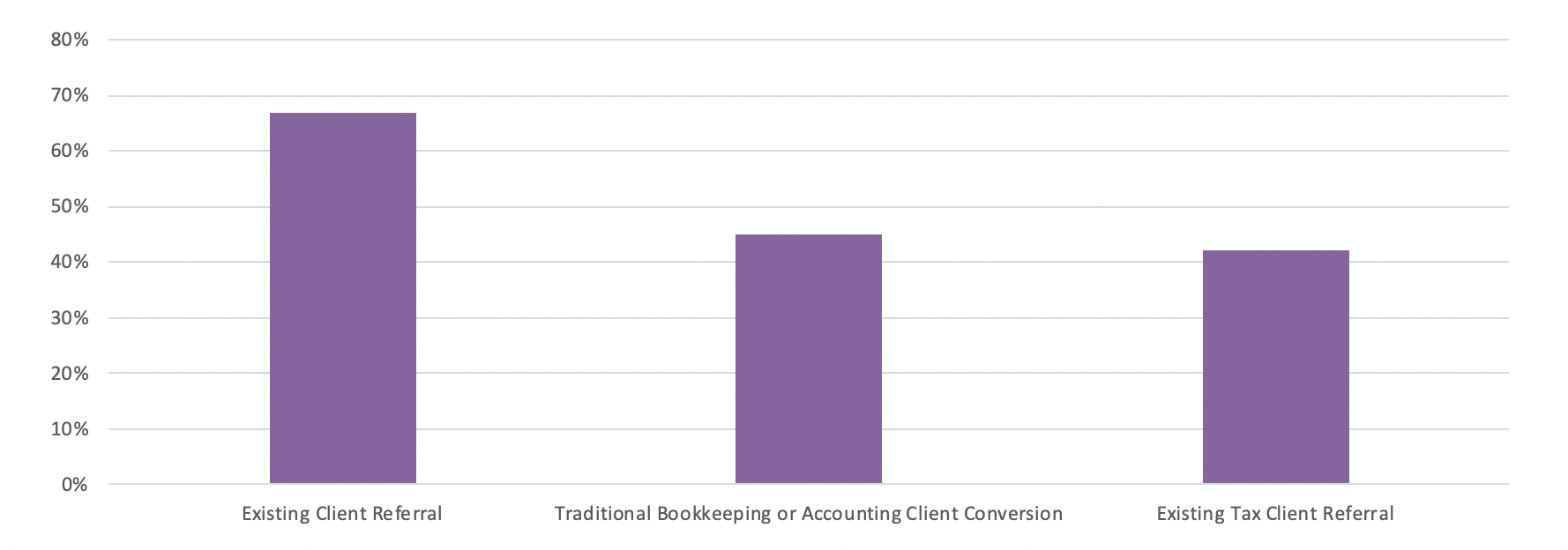

Once you have set client acquisition and revenue targets, you should identify where you want to begin sourcing your new clients. According to CPA.com’s 2018 CAS Benchmarking Survey, the top lead sources for qualified leads are existing client referrals, write-up conversions, and existing tax client referrals.

Inside Sales vs. Outside Sales

To place a qualitative value on internal referrals, it’s been estimated that it is seven times easier to sell to an existing client than to sell to someone who doesn’t know you. Understanding this should prompt two actions: 1) ensure that you have an internal referral bonus model so that front-line staff has an incentive to make referrals; 2) ensure the firm’s compensation model does NOT discourage internal referrals at the partner-relationship manager level. If an audit partner refers and existing assurance client to the CAS practice, their compensation should be tied to the overall value of the client relationship, not whether the revenue rolls up to assurance or client accounting services.

One Example Idea

Since many nonprofits have finance officers, evaluating the audit relationships for potential CAS conversions would be a good first step in executing your growth plan. A nonprofit with revenues of $1,000,000 could easily pay a base salary of $60,000 for a finance manager. With a 30% benefit load, that person’s salary would be $6,500 per month. If the firm offers a CAS solution at $6,000 per month, the firm would still be providing great value for the non-profit and net cost savings to the client.

Converting tax-write-up clients to CAS engagements has multiple benefits: 1) a tax engagement of $3,000 with $1,000 of write-up work could become an annual engagement of $4800, paid in $400 per month installments. In this arrangement, the client’s accounting is done monthly, the relationship manager can provide quarterly tax planning advice. In the fall, the advisor can provide strategic advice on minimizing tax liability and strategic insights on the purchase of fixed assets, tax credits or planning for a liquidity event.

Once you’ve leveraged your sources of internal referrals, you can begin focusing on building opportunities through organic lead generation activities, inbound marketing campaigns and other programs developed by your marketing and sales teams.

Edward D. Warren, MBA

Business Development Director

Ed is an accomplished sales executive with over 15 years of professional services sales and marketing experience. He’s worked for Allinial Global and RSM Alliance member firms and serves on the board of the Association of Accounting Marketing.Other Articles You Might Be Interested In:

How to Manage Your Outsourced Accounting Team

With businesses moving to a remote environment, there is a common question about how you manage an outsourced accounting team. How do you make sure their work aligns with your objectives? How do you form a healthy work-relationship with remote accountants? How do you...

read more

5 Business Tasks You Could be Outsourcing

Too many business owners think they don't need help with their tasks. They think that getting more hands involved means way more expenses for the company. Little do they know, outsourcing could actually help their business grow. (And save them money!) Repetitive or...

read more